What Are Education Loans in India and How to Choose One?

Student Finance

01 August, 2023

|

7 mins read

By Reem Mohamed

Share

What Are Education Loans in India and How to Choose One?

Student Finance

01 August, 2023

|

7 mins read

By Reem Mohamed

Share

A high-quality education is a must for many, and it is not exactly within everyone’s reach, this is why the concept of student loans came to life years ago and is still being used to this very day. Over the years, different types of student loans have been introduced to the market and as a student with little to no experience, you might find yourself struggling to understand all the types and having trouble choosing the right one for you.

This is completely valid and we’ve got your back! If you’re an international student, especially if you’re Indian, then this guide is for you! Getting an education loan in India, while easy, is still a process that needs prepping for and reading up on, and that’s what we’re here to help you with! We’re going to uncover how to get an education loan in India, all the different types of student loans India, and your overall education loan eligibility, so let’s start!

What Is an Education Loan in India?

An education loan in India, also known as a student loan, is the amount of money borrowed by someone to help fund their post-secondary education or other higher education-related expenses. The cost of tuition, books and supplies, and living expenses are all supposed to be covered by an education loan throughout the duration of the borrower’s degree. The period through which the loan should be repaid varies depending on the lender and their specific set of rules.

Education Loan Eligibility

What exactly qualifies someone to receive an education loan in India? Here’s a detailed look at all the things that make one eligible for taking out any of the student loans India!

In order to get approval on your education loan in India, you need to be enrolled in an approved undergraduate programme, postgraduate programme, PhD programme, diploma course of six months or longer, job-oriented course, or technical/professional course.

If you are applying for an education loan in India, you should be studying or trying for admission to an approved recognised institution, government institution, professional institution, or international college or university.

A 10 + 2 (12th standard) should be completed by education loan applicants for an undergraduate course and a degree should be completed for postgraduate applicants.

A number of documents are required to help applicants qualify for an education loan in India, below is a detailed list of said documents.

Documents Required for Student Loans India

An admission letter from the educational institution

Marksheets (previous education - school/college)

Age proof

ID proof

Address proof

Signature proof

Salary slips

Recent bank account statements

ITR with income computation

Audited balance sheet

Recent bank statements

Proof of turnover (service tax return/sales receipt)

Completed application form with signature

Latest passport size photographs

Appropriate Visa for studies abroad

Expenses Covered by an Education Loan in India

Before choosing the ideal education loan in India for you, let’s first take a look at all the expenses your student loan of choice is expected to cover, here’s a detailed list!

Educational institute fees.

Examination/library/laboratory fees.

Travel expenses/transportation and passage money for studies abroad.

Insurance premium for student borrowers, if applicable.

Caution deposit, building fund/refundable deposit supported by institution bills/receipts (total expense should not exceed 10% of total loan).

An allowance for books/equipment/instruments/uniforms (total expense should not exceed 20% of total loan).

A fee for purchasing a computer at a reasonable cost, if required to complete the course (total expense should not exceed 20% of total loan).

Any other expense required to complete the course, such as study tours, project work, thesis, etc. (total expense should not exceed 20% of total loan).

Courses Covered by Student Loans India

Student loans India can cover a number of different courses and degree programmes, including the following:

Graduation and post-graduation courses (professional/technical/diploma) offered by approved universities or colleges under UGC, IMC, AICTE, government, AICTE, AIBMS, or CMR

Regular degree or diploma courses administered by autonomous institutions such as IIM, IIT, IISc, XLRI, NIFT, NID, ICWA, CA, CFA, etc.

Regular degree or diploma courses such as pilot training, aeronautical, shipping, and more approved by the Director General of Civil Aviation, Shipping, or other regulatory authority.

Job-oriented courses (professional/technical) for graduation, post-graduation, or diploma such as MBA/MCA/MS, courses conducted by the Chartered Institute of Management Accountants (CIMA) - London or Certified Public Accountant (CPA) - USA.

Loans for skill development.

How to Choose an Education Loan in India?

Choosing the right education loan in India mainly depends on your needs. There are various types of student loans India, each one covering a particular need or requirement you might be looking for in a student loan and how much interest are you willing to settle for. So, in order to choose the right education loan in India, you need to first familiarise yourself with all the different types of education loans available in the country and their interest rates!

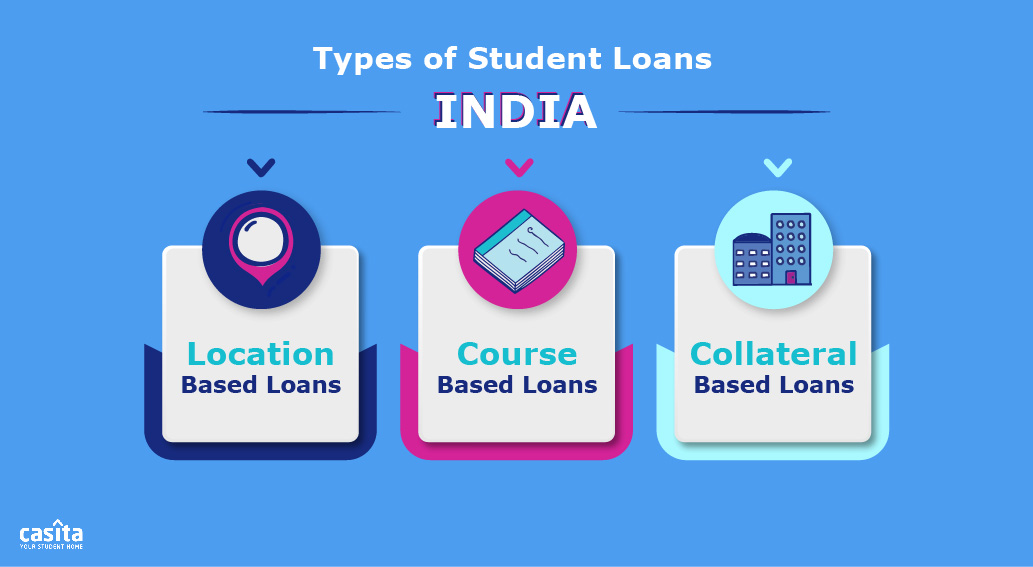

Types of Student Loans India

Location-Based Loans

1. Domestic Education Loan

Students who want to pursue a degree in India can apply for this type of loan. The loan’s approval depends on the applicant’s acceptance into an Indian educational institution and meeting all other eligibility requirements.

2. Overseas Education Loan

This loan is designed for Indian students who wish to pursue higher education in a foreign country. An overseas education loan usually covers travel, accommodation, and tuition fees, provided the applicant is accepted in an institution of higher education abroad and meets all other eligibility requirements.

Course-Based Loans

1. Undergraduate Loans

True to its name, this education loan in India provides students with the necessary funding to complete an undergraduate degree. This loan is usually enough to offer the necessary financial aid throughout the duration of an undergraduate degree, which is around three to four years.

2. Postgraduate Loans

Students who want to pursue postgraduate studies can apply for this loan that will help cover their expenses over the course of their 2-year postgraduate study period.

3. Career Development Loans

Many working professionals apply for education loans in India to start taking professional courses and training to improve their employment prospects. A career development loan is available to help them with their professional development, provided they fit the eligibility criteria.

Collateral-Based Loans

1. Loan Against Property, Deposits, and Securities

You can take out an education loan in India against immovable assets like agricultural land, residential land, flats, house, and others. You can use fixed deposit certificates, recurring deposits, gold deposits, bonds, debentures, and equity shares to get the necessary financing to pursue education.

2. Third-Party Guarantee

This is basically a guarantee letter from an employee of the bank issuing the loan or the home bank that can help the student get their education loan in India.

Interest Rates of Different Student Loans India

Bank Name | Interest Rate |

Union Bank of India | 11.30% onwards |

SBI | 8.20% onwards |

Bank of Baroda | 9.15% onwards |

Central Bank of India | 8.20% to 11.50% |

Canara Bank | 8.60% onwards |

Axis Bank | 13.70% to 15.20% |

Kotak Mahindra Bank | Up to 16% |

Bank of India | 9.25% onwards |

Bank of Maharashtra | 10.30% to 11.95% |

IDBI Bank | 9.10% onwards |

IDFC FIRST Bank | 9% to 15% |

PNB | 8.55% onwards |

ICICI Bank | 9.85% onwards |

Indian Overseas Bank | 11.05% onwards |

Federal Bank | 12.55% onwards |

HDFC Bank | Rates are college or university dependant |

Additional Steps to Consider when Choosing a Loan

How Much Money Do You Actually Need?

An education loan in India could cover only a few expenses or cover everything from tuition fees to travel costs, examination fees, student accommodation costs, and living expenses. So it’s beneficial to calculate all the expenses you will have to determine the loan amount you need. It’s important to take into consideration the interest rate, the processing fees, the type of loan, and the repayment conditions.

Indian state banks offer education loans ranging from Rs. 2 lakh up to Rs. 40 lakh, however, private banks offer loans that start from Rs. 50,000 up to Rs. 1.5 crore. Non-Bank Financial Companies (NBFCs) offer education loans with no maximum amount. Its minimum loan amount is Rs. 50,000 for education in India and Rs. 1 lakh for international education.

Normally, banks don’t request a co-borrower/guarantor or tangible collateral security for education loans of Rs. 4 lakh or less. If your educational loan is between Rs. 4 lakh and Rs. 7.5 lakh, banks request a third-party guarantor. Nevertheless, banks will usually ask you to submit collateral security if your loan is more than Rs. 7.5 lakh.

What Are the Repayment Terms?

Ask your education loan provider about the repayment terms, especially the following two terms:

1. Moratorium Period

This is the period you can spend without paying your loan after completing your studies. It ranges from six months to a year. Once this period is over, you will need to start repaying your loan, even if you don’t have a job yet. Private or NBFCs may ask you to pay simple or partial interest rates while you are studying, so ask about that as well.

2. Loan Tenure

Loan tenure is the timeframe you are expected to repay your loan within. It lasts up to 15 years in state banks, 20 years in private banks and 10 years in NBFCs. Similar to the interest rate, loan tenure can save you money. The longer the tenure is, the higher the interest will be. Adding one year to the repayment period increases the interest amount.

Benefits of Getting an Education Loan in India

After choosing the right education loan in India for you and your educational prospects, it’s good to be reminded of the benefits that come along with it, here are a few of them!

Certain conditions can get loans that are up to 100% financing.

The loan amount can go up to Rs.1 crore for international students and up to Rs.50 lakh for domestic students.

The financing covers other expenses, such as student exchange travel expenses and a laptop, if needed.

Preferential forex rates may be available for international disbursements.

Parents should be joint borrowers for the education loan.

Loan repayment tenure can go up to 15 years.

Loan moratorium period of up to 6 months to 1 year from completing the course.

Tax benefits up to 8 years on the loan interest payment.

Getting an education loan in India is the first step towards a brighter future, whether you’re studying in or out of the country. Whatever degree you wish to obtain, it is now made possible through the different types of student loans India. You can also check out the best education loan providers in India and how to apply for one while you’re at it! Or maybe even try applying through Casita. So, using this as your guide, we urge you to do your research and sign up for that education loan in India today!

Student Finance

By Reem Mohamed

Share

Student Finance

By Reem Mohamed

Share